Meeting or exceeding expectations

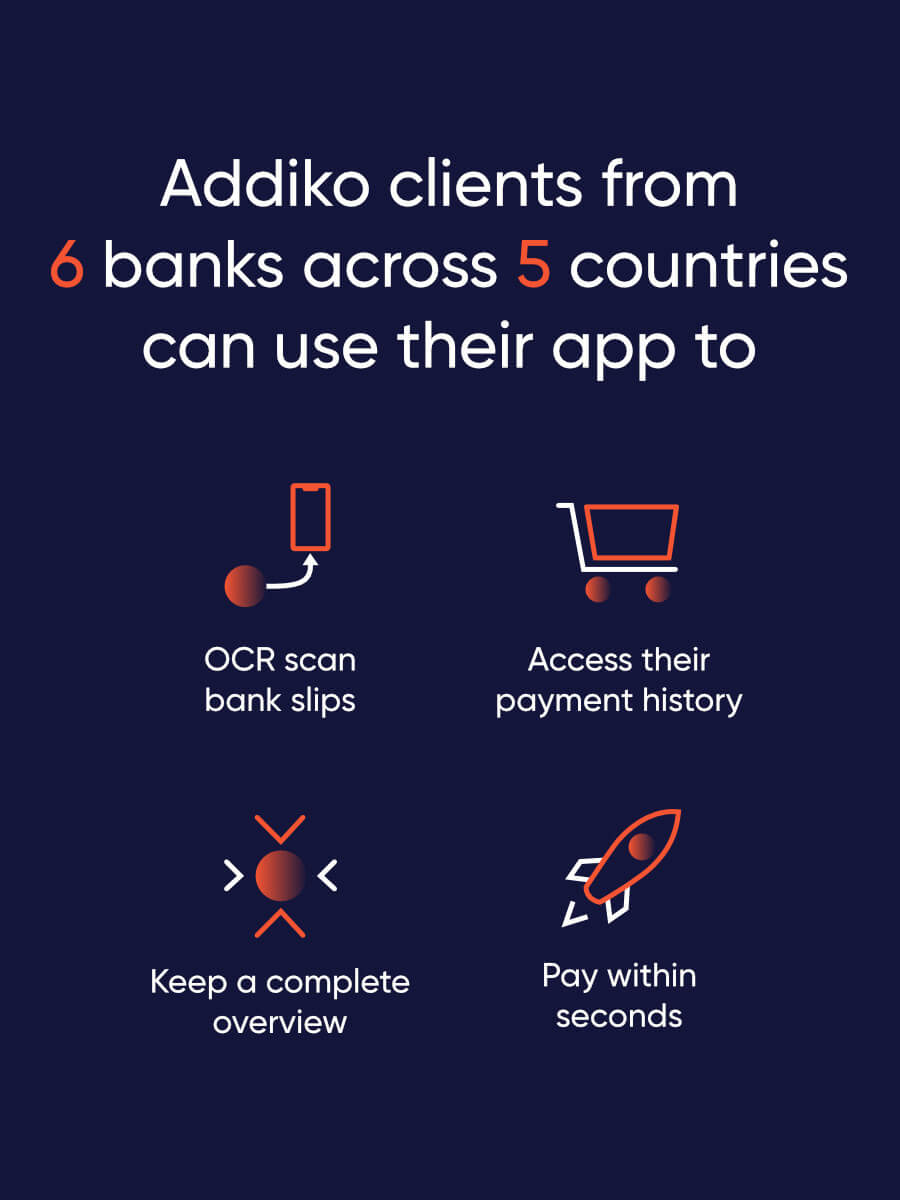

The applications are rated as best mobile banking solutions in Serbia and other markets while continuing to enjoy an average app rating of over 4 in the App Stores. The ambitious delivery targets were met while keeping the quality of the solution very high. The engagement goals in terms of active usage of the application such as number of users, number of transactions, logins per month and so on are continuously met or exceed the set of KPIs.

The competence center

Together with Addiko we established a partnership model where, as part of the project Zentity helped with recruitment of new teams for the bank. The bank team spent significant time with the Zentity team at both bank’s and our location to learn about the solution and fill the skills gap. The Digital Competence Center initiative has been very successful and has grown to over 20 FTEs. The DCC continues to improve the app with new and advanced features.

Core banking Integration

A group wide solution required complex integration. The architecture of mobile banking is designed flexibly by using the Zentity Digital Server, that allows for easier and more secure connections with existing bank systems across 5 markets. In addition to the integration layer, the Zentity Digital Server brings abilities such as end-to-end localization, mock-interfaces, content management, content caching and more. Due to the multi-country, multi-language and multi-currency requirements the application was built in such a way that there is a common core and an abstraction to accommodate country specific business logic.

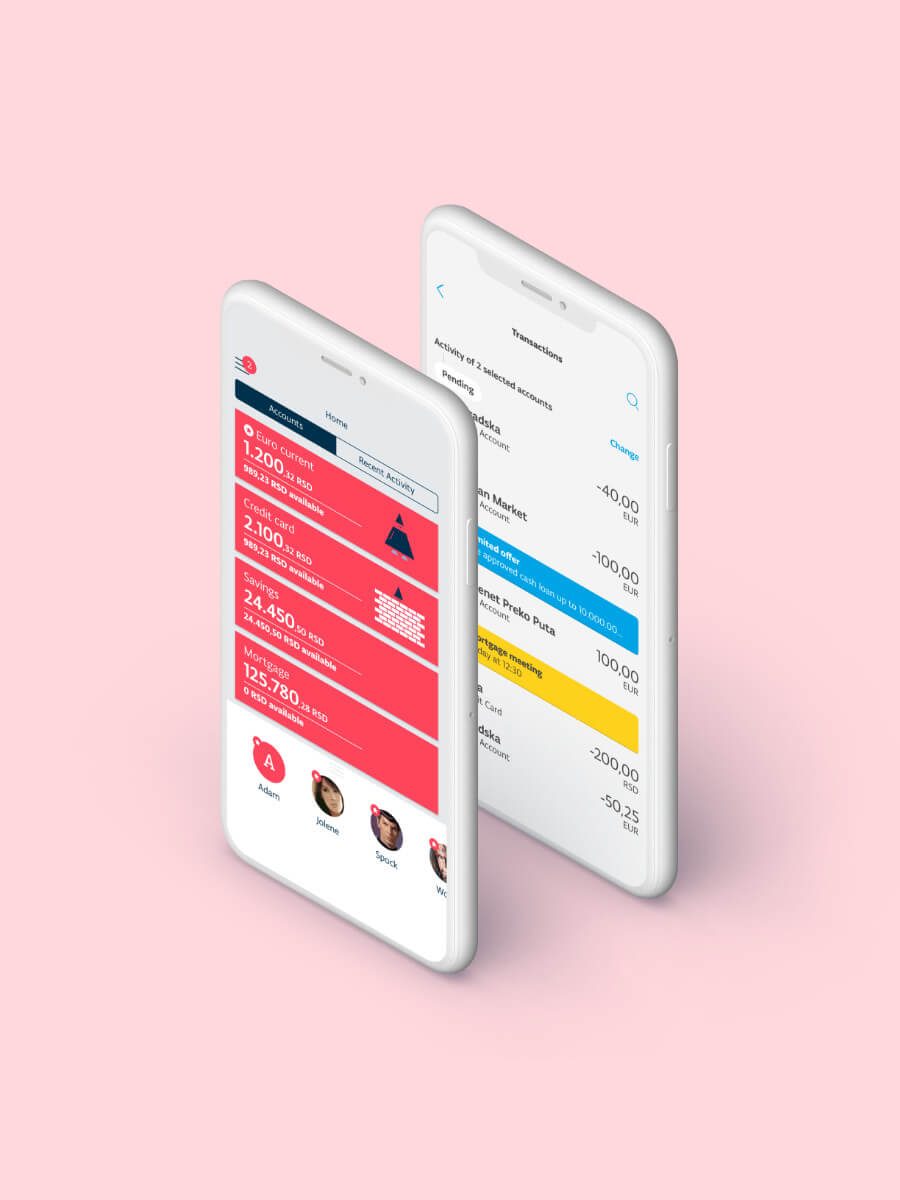

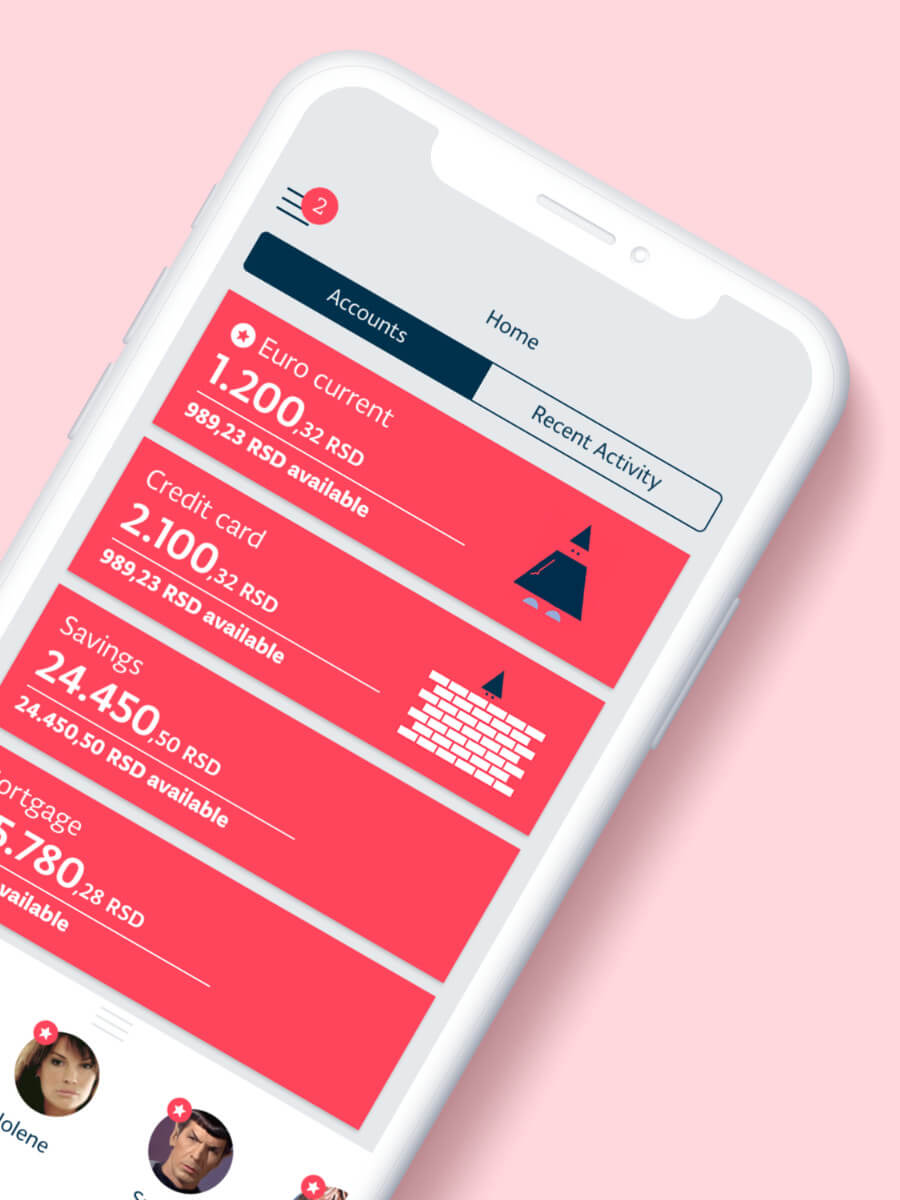

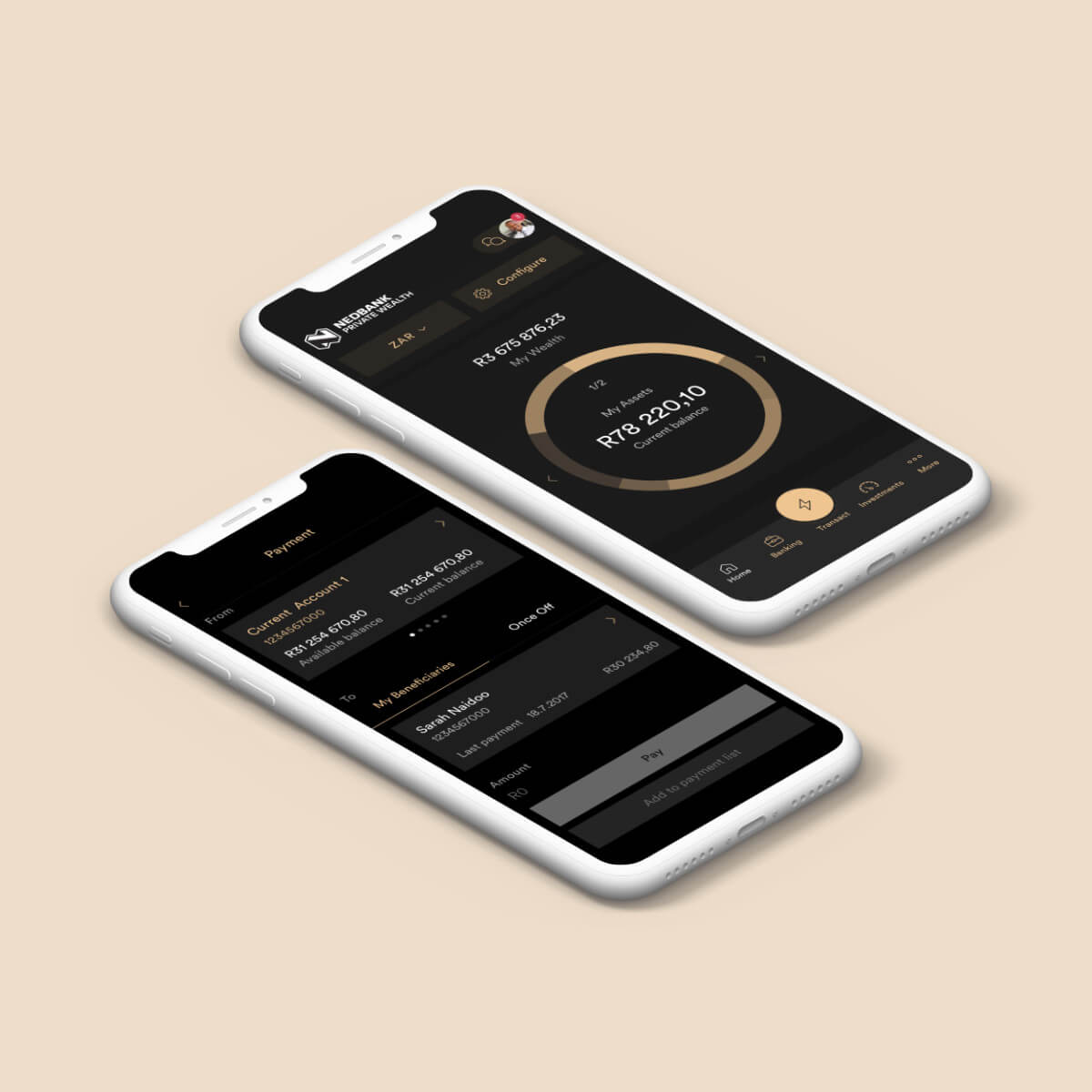

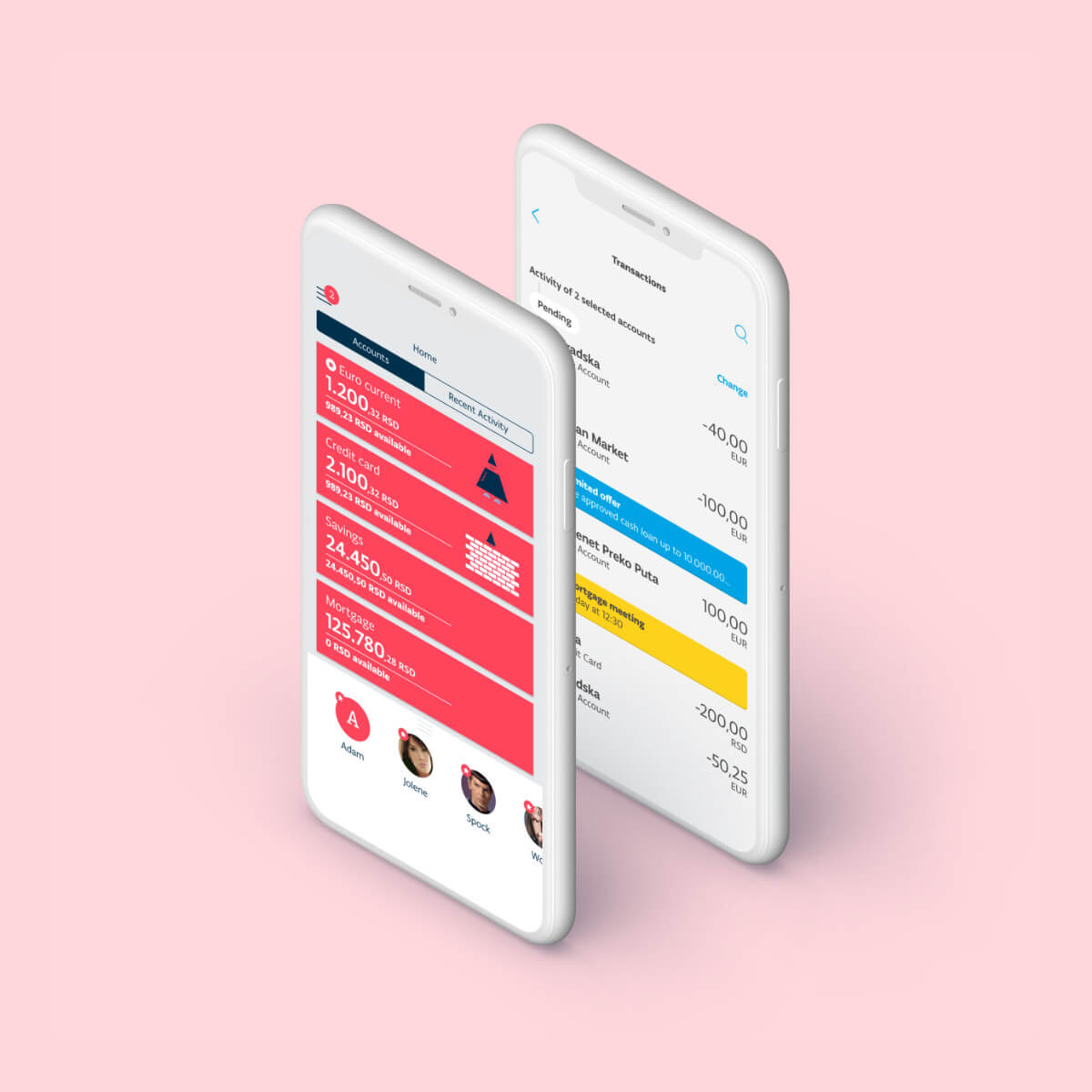

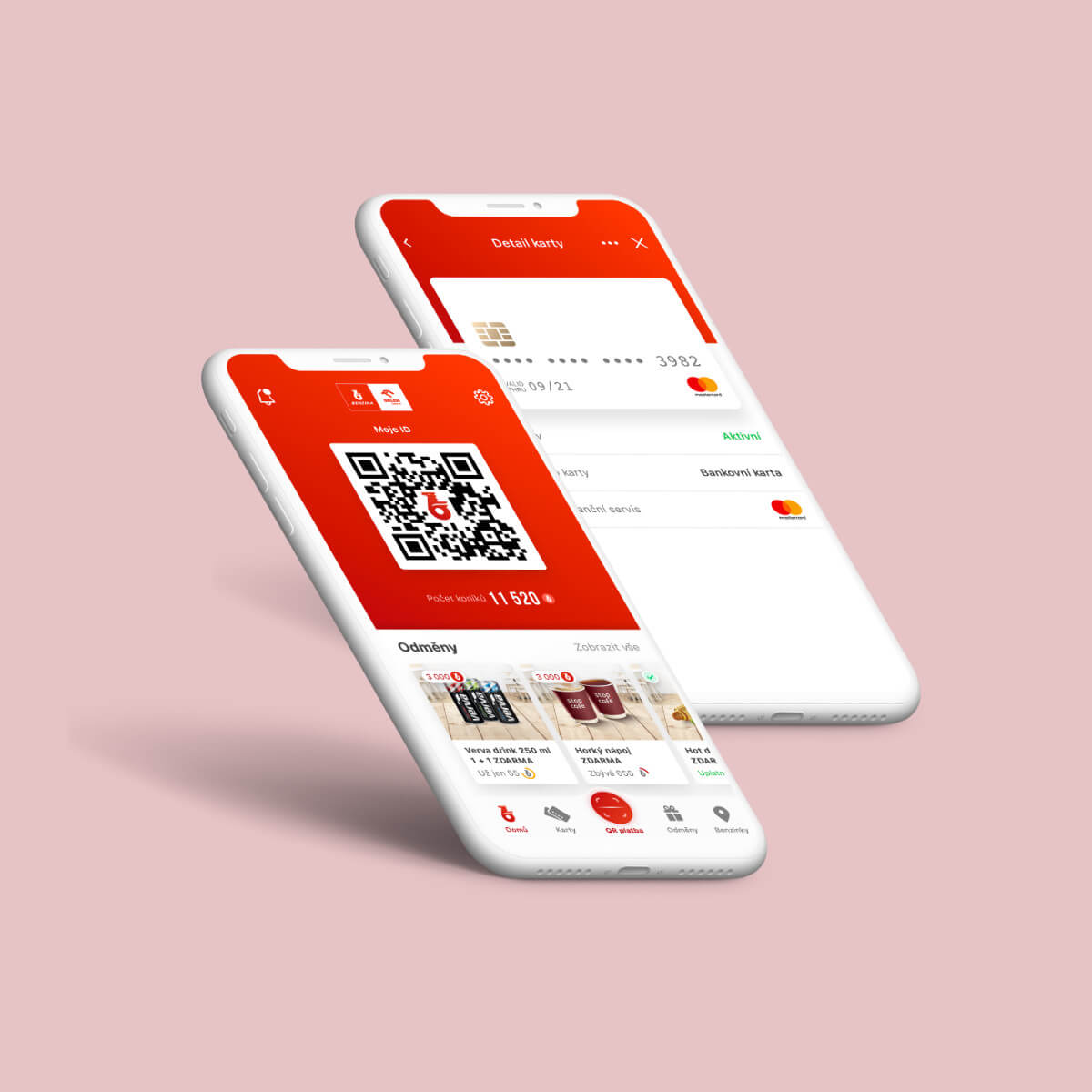

Application Front-ends

User-experience (UX) is the central focus of this Mobile Banking solution. The application enjoys wide acceptance among its user base and has won various industry awards. Both iOS and Android platforms offer a UX that is in line with the platform standards and at the same time clearly allows the banks branding stand out.

This makes the application easy to maintain and support which therefore lowers the long-term total cost of ownership (TCO).