As penetration of smartphones is growing steadily and managing banking services on customers’ smartphones has become standard, Nedbank decided to provide its customers with innovative and advanced digital channels.

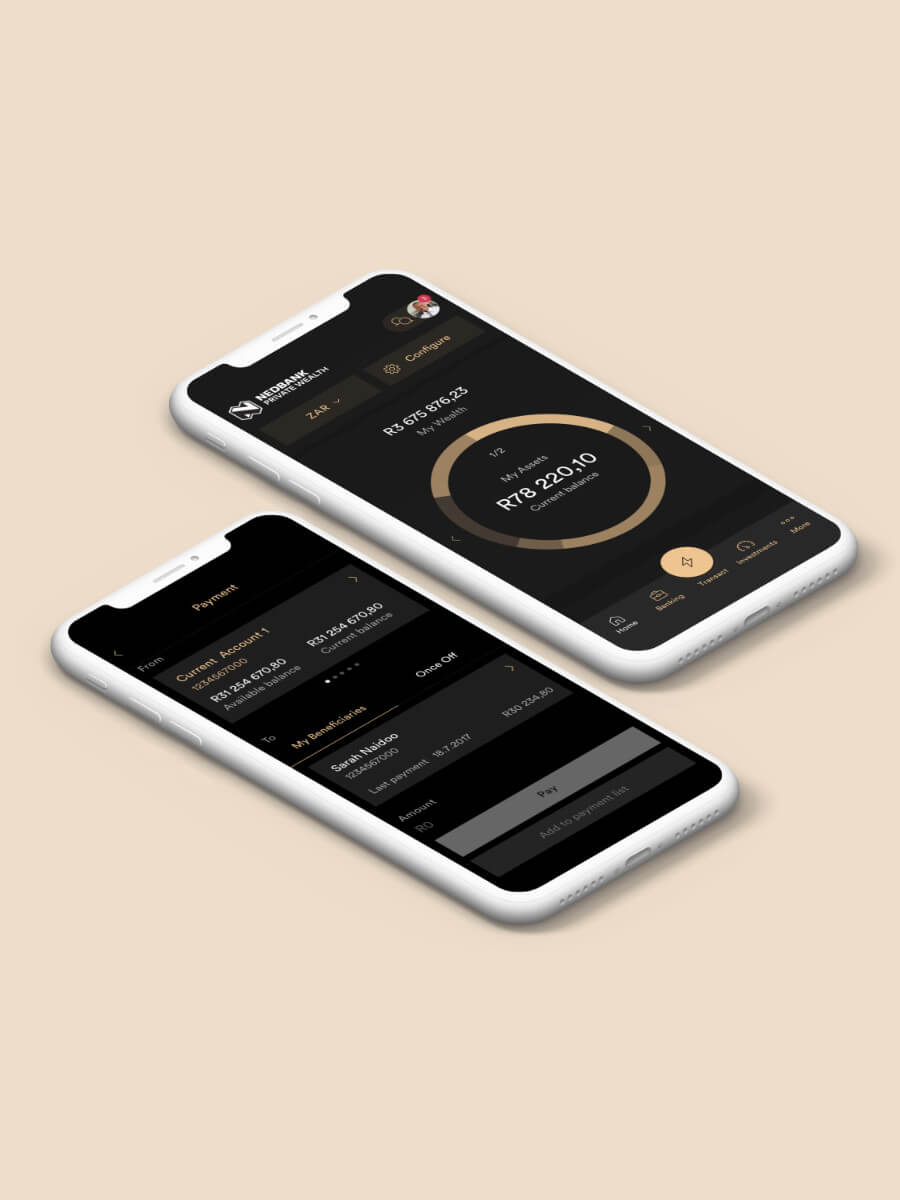

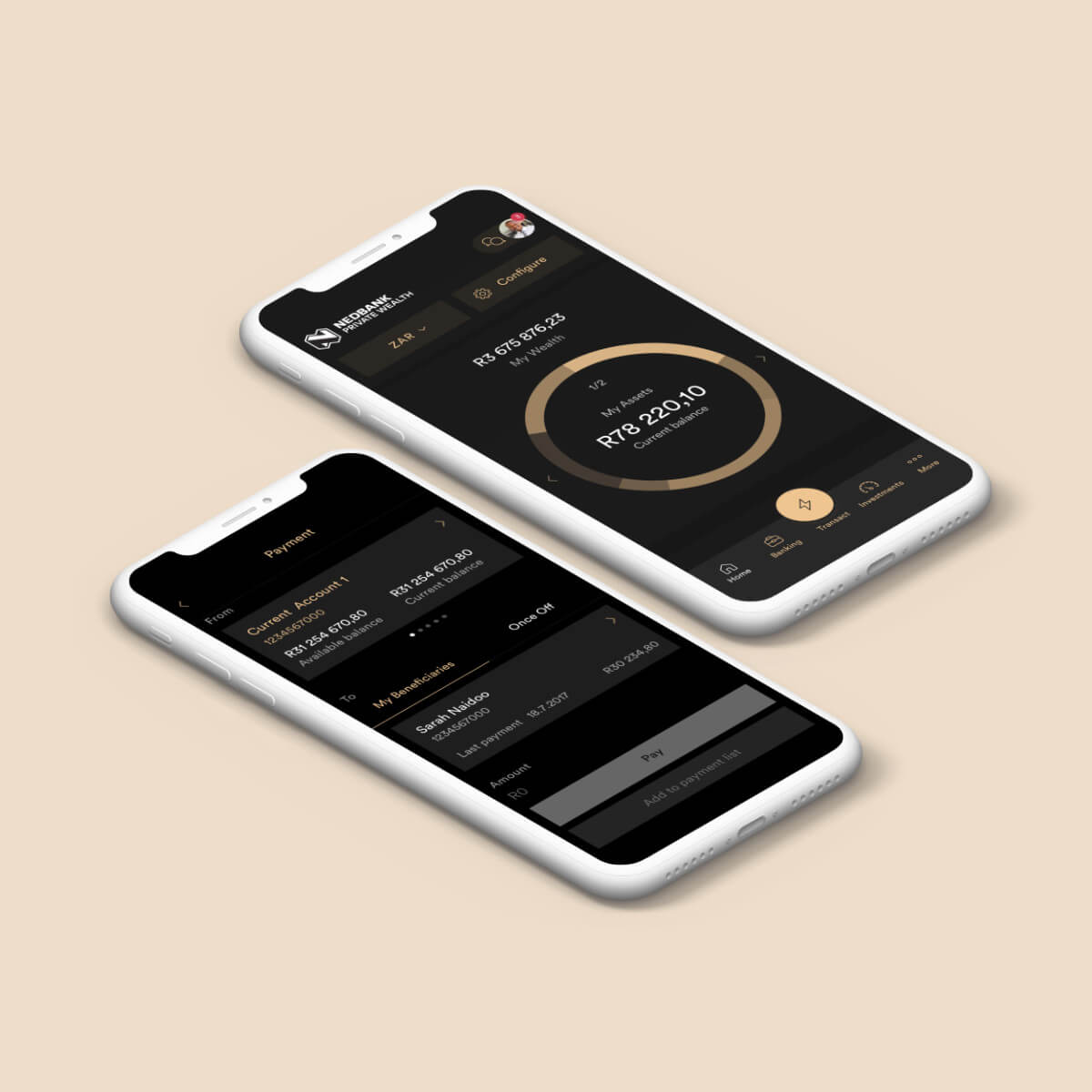

Nedbank decided to create a sophisticated mobile channel which has a state-of-the-art design and easy to use navigation and handling.

The application is supposed to deliver both convenience for Nedbank’s customers as well as easing up operations of Nedbank customer service processes.

Private Banking App — Rated #2 Globally